Subscription apps have been riding a bullish wave. Pandemic-era tailwinds fueled an unprecedented surge in mobile usage and digital spending, rapidly accelerating adoption across categories like wellness, education, and streaming platforms. In 2021 alone, global consumer spend on subscription-based mobile apps reached $18.3 billion on iOS and Google Play combined.

That momentum hasn’t disappeared, but it has matured. Today, the market is more saturated, the competition is stiffer, and user acquisition is more expensive. In North America, the average cost per install (CPI) hit $5.28 in 2024, with similarly high CPIs across other premium markets.

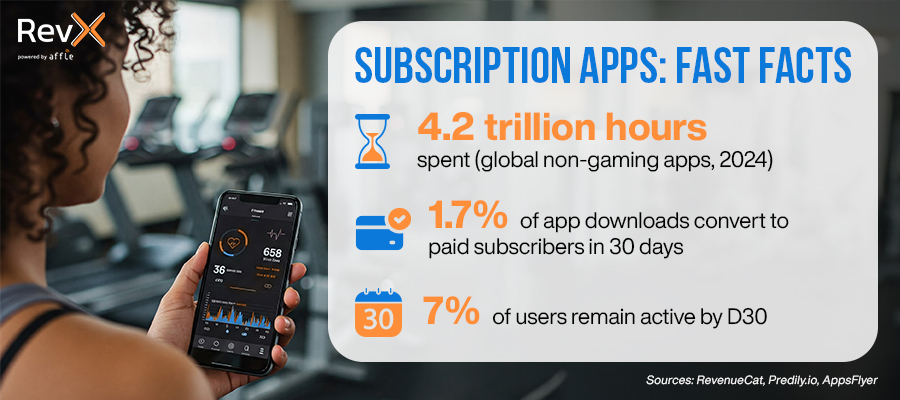

At the same time, the rise of non-gaming consumer apps is expanding how users engage with mobile experiences, from fitness to finance and productivity. According to AppsFlyer, non-gaming app downloads rose 12% year-over-year, outpacing overall app growth. Sensor Tower data shows that users spent 4.2 trillion hours in non-gaming apps globally in 2024, reflecting how embedded these apps have become in daily life.

However, users are now more discerning, quicker to churn, and less forgiving of subpar experiences. With a growing plethora of choices at their fingertips, many are unwilling to commit unless the value is immediate and clear. Trial-to-subscribe conversion rates are flattening: for instance, data indicates that only 1.7% of app downloads convert to paid subscribers within 30 days.

Moreover, economic uncertainties have led to more cautious spending habits, with consumers prioritizing stability and predictability. This shift is evident in the growing preference for fixed-cost services that offer clear value propositions and reduce financial unpredictability. While services like streaming platforms maintain steady engagement, there’s a noticeable decline in subscriptions for physical goods and non-essential services. In the travel sector, there’s a noticeable move from frequent, budget-friendly trips to fewer, high-quality experiences. Travelers are seeking personalized and premium experiences that enhance well-being, even if it means traveling less often. There is a desire for intentionality and depth over quantity in leisure activities.

For subscription apps, these behavioral shifts point towards the importance of delivering immediate, tangible value that aligns with users’ evolving priorities.

Now, let’s break down why the old install-to-subscribe funnel, optimized for volume and rapid onboarding, is due for a rethink:

Many early mobile app marketers adopted tactics pioneered by mobile gaming companies. These tactics prioritized volume over longevity. The same logic was applied to early-stage subscription apps. However, today’s non-gaming consumer apps operate in mature, competitive categories like utility, FinTech, and health, among others, where users expect not just functionality, but a personalized, valuable, and sustained experience.

Focusing on short-term wins like installs and sign-ups often obscures a much deeper problem:

🕳️ Users drop off after their first interaction. When early experiences aren’t engineered to reinforce the app’s value or build momentum, users disengage before they convert.

🔒 Privacy changes like Apple’s SKAdNetwork (SKAN), AdAttributionKit, and App Tracking Transparency (ATT) have broken the precision of traditional targeting and attribution. As signal loss deepens, campaigns optimized purely for installs or even trials are becoming blunt instruments.

📈 CPIs are rising, and cost-per-trial is no longer a reliable predictor of lifetime value (LTV). Without engagement, trials become empty metrics, and user acquisition costs quickly outpace returns.

For subscription apps, where revenue is realized over time, conversions without engagement lead to mounting customer acquisition costs and unsustainable growth. The install-to-subscribe funnel worked in an era when data was abundant, acquisition was lighter on the budgets, and consumer expectations were lower. In 2025, performance is about cultivating early value, reinforcing user intent, and building repeat engagement.

Acquisition Messaging: The First Retention Filter for Subscription Apps

Many advertisers assume retention begins with a clever win-back flow or a smooth onboarding sequence. For subscription apps, retention starts much earlier. It starts with the first message a prospective user sees. If your acquisition strategy leans on generic messaging, limited-time discounts, or urgency tactics, you’re not just casting a wide net, you’re setting yourself up for churn.

When there’s a disconnect between the promise made in the ad and the experience delivered in the app, users churn later not because the product failed, but because they were never the right fit to begin with. For instance, a user drawn in by an ad promising instant weight-loss hacks is unlikely to stay engaged with a fitness tracker subscription designed for gradual progress and long-term habit-building.

This is why acquisition needs to serve as a retention filter, not just as a top-of-the-funnel strategy. Messaging should be bold enough to resonate with the right users and honest enough to deter those who are not. This alignment early on improves trial-to-subscribe rates and lays the foundation for long-term retention.

Next, to improve retention rates for subscription apps, developers must build post-install strategies focused on user value and behavior, not just volume.

The Retention-First Funnel

Today’s mobile users are spending more time in apps than before. However, that time is fragmented, split across dozens of competing experiences. This presents both a challenge and an opportunity for subscription app developers: how do you turn brief interactions into lasting engagement?

Subscription retention now defines growth. According to recent data, nearly 30% of annual subscriptions are canceled within the first month.

To drive sustainable growth, subscription apps need to engineer engagement loops early, within the first few sessions that reinforce the app’s core value and create stickiness. This means optimizing for early behavioral signals such as feature usage, content consumption, or interaction with specific parts of the app.

One effective framework for engineering these loops is the habit loop, which consists of a cue (a trigger that initiates behavior), a routine (the action the user takes within the app), and a reward (the benefit or satisfaction the user gains). Designing app experiences that intentionally elicit desired behaviors and provide satisfying rewards can encourage repeat engagement.

Early repeat engagement is one of the strongest predictors of subscription success. While benchmarks vary by category, many top-performing apps monitor session depth and return frequency within the first week as leading indicators of long-term value.

According to 2024 data from Predily, the average Day1 retention rate for mobile apps hovers around 25%, with only 7% of users remaining active by Day30. That means three out of four users churn within a day, and more than nine out of ten are gone within a month. That’s a steep drop-off.

Improving retention rates for subscription apps means prioritizing value delivery during the earliest moments of the user journey.

Why Onboarding and Paywalls Matter for Retention Rates and Subscription Apps

80% of trials start on Day 0, the very first session. That means your onboarding experience and paywall visibility have to be airtight.

Apps that surface their trial offer during onboarding consistently outperform those that wait. High-performing apps design this journey with intent: streamlining registration via Apple or Google SSO, using onboarding quizzes to personalize early value, and optimizing the paywall for visibility and clarity.

Paywall strategy is also evolving. Higher-priced apps show better download-to-trial conversion rates (9.8% vs. 4.3% for lower-priced apps), suggesting users who download premium-priced products are more intent-driven. However, those same lower-priced apps see better trial-to-paid conversion rates (47.8% vs. 28.4%). Balancing trial start rate and LTV is key. You could consider employing dynamic paywalls that adjust the offer based on user engagement signals or behavior within the app.

Premium positioning and hard paywalls are gaining traction, especially in categories like Health & Fitness (12.1% P90 trial-to-paid conversion) and Business (10.1%). These apps pair a clear, upfront value proposition with early premium exposure.

Best-in-class apps are also experimenting with reverse trials, granting full access to premium features upfront with no payment required. This approach, seen in apps like Strava and Ladder, lets strong product/market fit do the heavy lifting, building confidence before the upsell.

Preserving Retention Rates for Users After the First Subscription App Session

Apps like Brilliant.org and Duolingo have excelled at creating successful first sessions. Some of their most effective tactics include:

- Short, self-contained first sessions that deliver a quick win or moment of gratification.

- Celebratory feedback loops such as streaks, badges, animations, or summaries that spark dopamine and signal progress.

- Identity-based framing, where users don’t just complete a task but become a “learner,” “meditator,” or “creator.” This primes long-term motivation.

- Behavioral nudges, like subtle push opt-ins or in-app cues, that guide users to return the next day.

- A clear next step showing users what’s waiting for them tomorrow helps reduce decision fatigue and deepen commitment.

When apps can identify users who completed their first session but didn’t return for a second, they’re in a strong position to design more effective re-engagement campaigns. Using session-based segmentation, marketers can deliver personalized creatives that speak directly to where a user left off, whether that’s a goal they didn’t finish, a streak that’s waiting to be claimed, or a reward they’re close to unlocking.

Cross-Platform Retargeting for Healthy Habit Reinforcement in Subscription Apps

Today’s users don’t live solely on mobile; they switch channels across multiple platforms. In 2024, U.S. adults spent nearly a third of their media time on mobile (31.7%). At the same time, 88% of American households now own at least one internet-connected TV device, highlighting just how embedded cross-device media consumption has become.

For subscription apps, this creates a new imperative. Retargeting can no longer be siloed to mobile alone. Instead, it must evolve into a cross-platform strategy that supports habit formation wherever the user happens to be: in-app, on social media, on desktop, or watching Connected TV.

When done right, cross-channel campaigns become a natural extension of the app experience, reinforcing the same behavioral cues introduced in the first session.

For example, a fitness app might regularly advertise during popular live sports events. The targeted ads during “team highs” remind a trial user of an unclaimed offer to subscribe, a win they can also win on the app, that message is served through via a CTV ad. Or a language learning app might prompt continuation of French learning streaks through web-based dynamic interactive ads, such as countdown ads, to prepare and anticipate how many days before summer celebratory holidays, such as Bastille Day.

These nudges work because they maintain continuity across touchpoints relevant to high-value users, reactivating intent without depending on the user to reopen the app themselves.

Apps that use contextual triggers like weather data or user location, combined with AI-driven propensity models, can create dynamic retargeting strategies that feel helpful, not spammy.

DSPs with AI-powered bidding and multi-channel execution capabilities make this scalable and efficient, helping marketers prioritize high-LTV users early without overspending.

Hybrid Monetization is the New Growth Lever for Retention of Subscription Apps

In 2024, 35% of apps mixed subscriptions with consumables or lifetime purchases. Gaming (61.7%) and Social & Lifestyle (39.4%) are leading the charge, but categories like Health & Fitness and Productivity are beginning to follow.

Hybrid models help apps monetize different user segments, including those who won’t commit to subscriptions but are willing to spend on individual features or credits. This is especially relevant for AI-powered apps, where usage-based pricing allows flexibility while protecting margins.

The takeaway: diversified revenue streams are becoming table stakes. Subscription apps need to design monetization paths for both committed and casual users.

Shared Monetization Infrastructure: The Rise of Non-Gaming Publishing Houses

Beyond hybrid monetization tactics, a new operational model for consumer apps to scale is emerging: the non-gaming publishing house. Ukrainian-based Genesis Tech is a prime example. Genesis Tech co-founds non-gaming app startups and provides them with centralized expertise in user acquisition, analytics, and marketing infrastructure. This frees up product teams to focus exclusively on product development, while the holding company accelerates market entry and growth.

Flagship apps in their portfolio include: Headway (a microlearning app offering bite-sized book summaries), BetterMe (a wellness platform for fitness and nutrition), and PlantIn (a plant care app). What unites these diverse apps is not category, but a shared monetization engine. All rely heavily on subscriptions, layered with feature unlocks, time-limited offers, and personalized pricing tiers. Each new Genesis app benefits from a repeatable monetization template, continuously optimized using real-time data and portfolio-wide insights on segmentation, pacing, and pricing.

In essence, Genesis Tech has built a “monetization metagame” that remains consistent across their app family, while each app varies the core user experience, whether that’s reading, exercising, watering plants, or even cleaning phone files. This structure compounds growth, speeds up time-to-profitability, and drives higher lifetime value (LTV) at scale.

In Conclusion

Subscription retention now starts before the install and is reinforced with every session after. The most effective subscription apps attract the right users and deliver value from the very first interaction.

Acquisition messaging is no longer just about clicks and conversions. It’s the first retention filter. If the promise in your ads doesn’t match the product experience, users will churn fast, no matter how polished the onboarding. Next, apps need to focus on what happens after the first session, using behavioral signals not just sign-ups. Creating frictionless bridges to the forthcoming sessions, encouraging habit formation, and reinforcing the user’s sense of progress are all critical pieces of the puzzle. Fast onboarding and install spikes mean little if they’re not followed by sustained engagement.

Retargeting plays a central role here, not as a tool for chasing churned users, but as a way to extend the product experience. When personalized and timed right, retargeting can nudge users back into their flow, spotlight underused features, or reconnect them with the value they signed up for in the first place. In other words, it becomes a continuation of your in-app journey, delivered beyond the app. This shift reframes retargeting from a reactive tactic to a proactive retention engine that sustains momentum between sessions, strengthens user identity, and drives deeper commitment over time.

When it comes to monetization, hybrid models and efficient pricing strategies are unlocking more value across user segments.

Subscription apps that treat session one as the beginning of a relationship, not a conversion opportunity, will be the ones that win.

If you’re ready to transform your subscription app’s retention and growth strategy, our team of RevXperts is here to help. Let’s build efficient funnels, richer experiences, and retargeting that performs. Get in touch with us to start turning session one into day 30 and beyond.