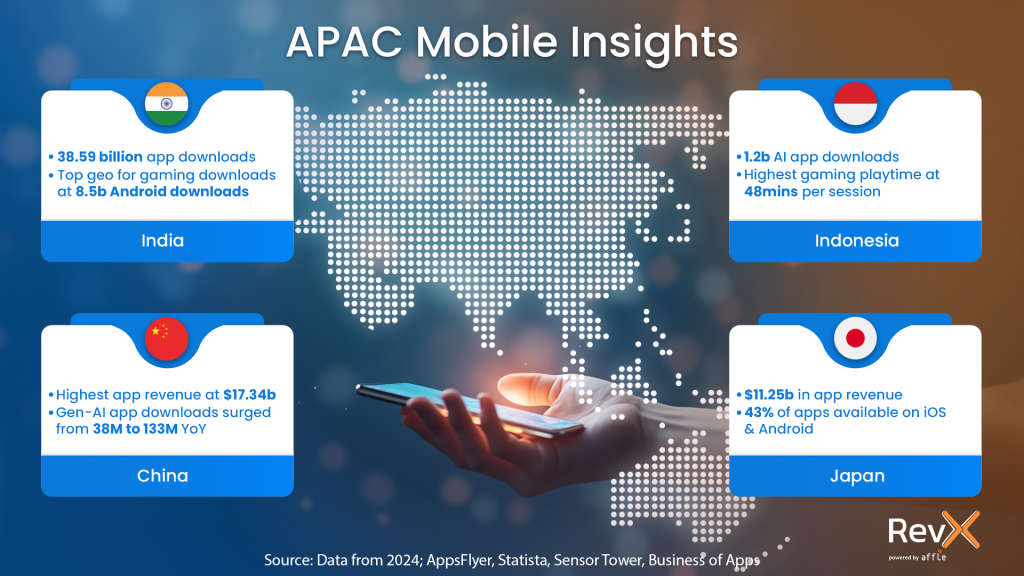

In 2024, mobile app downloads surged across Asia-Pacific (APAC), cementing the region’s position as the nerve center of the mobile economy. India led with 38.59 billion downloads, marking an 8.28% year-over-year increase, while Indonesia and China remained among the world’s top markets. Additionally, China and Japan ranked second and third in in-app purchase (IAP) revenue, generating $17.34 USD billion and $11.25 USD billion, respectively. This widespread growth reflects a mobile-first consumer base that is expanding and evolving.

But rising downloads and revenue tell only part of the story. As more users come online, with internet penetration in the region estimated to reach 77.31% in 2025, shifts in consumer behaviour and technological advancements are changing how brands connect with their audiences. APAC’s expanding middle class, equipped with increased disposable income, is driving a surge in demand for smartphones and app-related services. Additionally, the availability of budget-friendly feature-rich smartphones has democratized access to technology, enabling a broader population to participate in the digital ecosystem. So, what’s next for app marketers in APAC? An ecosystem in flux that demands constant adaptation.

Let’s explore the trends reshaping mobile marketing in APAC and setting the stage for what lies ahead.

🤖 AI’s Next Chapter: From Frenzy to Foundation

In 2025, AI in APAC will be about its stronghold in the market, and long-term impact. In China, downloads for Gen-AI apps skyrocketed from 38 million in 2023 to 133 million in 2024, while IAP revenue climbed to $28.8 million. India, Singapore, and Taiwan are mirroring this trend.

AI is no longer just a buzzword, it’s becoming an invisible yet indispensable force in the app economy. Downloads of apps mentioning AI-related terms in their names, subtitles, or descriptions surged to 3 billion in India (up from 2.3 billion in 2023) and 1.3 billion in China (up from 0.9 billion). Indonesia saw a similar leap, hitting 1.2 billion in 2024 from 0.7 billion the previous year. Even smaller markets like Singapore saw AI-related downloads rise from 27 million to 35 million. Talking about the genre of Gen-AI apps, AI chatbots continue to lead downloads, proving that utility drives engagement. AI art generator apps are also gaining traction, though at a slower pace.

The hype may be transforming, but AI isn’t going anywhere. It’s becoming a core part of the mobile experience. Instead of standalone AI apps driving growth, AI is now embedded within a wide range of platforms, from productivity tools to entertainment and shopping apps. Users may not always seek out “AI apps,” but they are interacting with AI more than ever, whether through smart recommendations, automated assistance, or creative enhancements.

🎮 The Mobile Gaming Market Expands, Albeit with Challenges

Asia-Pacific continues to be the heartbeat of mobile gaming, driving record-breaking downloads and engagement. In 2024, China ranked second worldwide in iOS gaming downloads with 850.41 million downloads, while India led Android gaming downloads with a staggering 8.8 billion. Indonesia also strengthened its position among the top five in Android downloads, with 3.42 billion downloads. Meanwhile, China saw the highest YoY growth in Android gaming downloads at 10.64%.

The region’s dominance is no accident. APAC is home to the world’s largest mobile-first audience, fueled by widespread smartphone adoption and a young, highly engaged gaming community. Players here aren’t just downloading, they’re also playing longer. Indonesia leads in playtime, averaging 48 minutes per session, followed closely by the Philippines (46 minutes) and Singapore (35 minutes). Action games take the crown, raking in the most installs and accounting for 27% of all playtime. However, niche subgenres such as racing, simulation, and arcade games are also gaining serious traction.

For advertisers, APAC is a bamboo forest of opportunity. But only if they play it right. In-game ads remain a powerful tool, but players are becoming more selective. Poorly placed, intrusive ads are pushing gamers away, signalling a need for seamless, well-integrated ad experiences. And 2025 won’t be all smooth sailing. Governments are tightening their grip on data privacy, ad policies, and game monetization. China’s regulations and South Korea’s evolving ad laws will force developers to adapt fast.

In APAC, one-size-fits-all doesn’t cut it; each sub-region has its own cultural preferences and gaming habits. Developers and advertisers alike will have to customize experiences to local tastes and navigate the regulatory maze. Brands that strike the right balance between monetization and experience while navigating the regulatory landscape have the opportunity to tap into an audience of over 1.5 billion mobile gamers, and unlock a market set to reach $195 billion in revenue by 2030.

📲 Alternative App Stores Win

In APAC, where over 2,000 languages are spoken daily, mainstream app stores don’t always cut it. China, Japan, and Korea have strong local preferences, and English-first apps struggle to break through. That’s why alternative app stores are rising fast, giving developers new ways to reach diverse audiences and increase revenue.

China’s app distribution landscape is a prime example. While Google Play is absent, Tencent’s MyApp has emerged strong with Tencent’s vast ecosystem, which reaches approximately 1.26 billion users. MyApp benefits from deep integration with WeChat and Tencent’s extensive suite of apps. Similarly, Korea’s ONE Store has carved out a strong presence by offering extensive localization and flexible monetization options.

In India, with its diverse linguistic landscape of 22 officially recognized languages and hundreds of widely spoken regional dialects, there is a strong demand for hyper-localized content. While mainstream app stores like Google Play and Apple’s App Store continue their stronghold, alternative app stores and OEM platforms are gaining traction by serving users in their preferred languages and offering region-specific content. Meanwhile, Singapore’s position as a tech and gaming hub makes it a natural testing ground for new app store models.

For developers, alternative app stores mean better discoverability, flexible monetization, and access to high-growth regions. Unlike Google Play (which hosts 3.3 million apps) and Apple’s App Store (which has 2.2 million apps), alternative app stores typically have fewer competing apps, making it easier for new and smaller apps to gain visibility and attract users.

Beyond country-specific platforms, original equipment manufacturers’ (OEM) app stores from brands like Xiaomi, Oppo, Vivo, and Samsung are also expanding their reach. Xiaomi’s GetApps, now available in over 100 markets, boasts more than 260 million monthly active users (MAUs) and sees over 30 million daily app installations, making it a powerful distribution channel for developers. Huawei’s AppGallery and Samsung’s Galaxy Store further enhance the ecosystem by offering built-in marketing support and premium placement opportunities.

🧰 From WeChat to Grab: Super-apps Own APAC’s Digital Space

APAC continues to witness a remarkable rush in the adoption and evolution of super-apps—multifunctional platforms that integrate various services such as messaging, payments, e-commerce, and more into a single application. This trend is driven by the region’s mobile-first consumer base, cultural market homogeneity, a significant unbanked population seeking accessible financial services, and a growing demand for seamless digital experiences. Over three-fourths of adults in APAC are either unbanked or underbanked, making digital wallets and financial services within super-apps an important bridge to financial inclusion.

Southeast Asia follows the larger APAC trend, with a significant portion of consumers in the region still lacking access to traditional banking. Super-apps such as Grab and GoTo have stepped in to fill the gap. Originally a ride-hailing service, Grab has expanded into food delivery, digital payments, and financial services across multiple countries. Likewise, GoTo, the parent company of Indonesia’s Gojek and Tokopedia, has leveraged its extensive user base to scale into e-banking, mobile banking and investment services, addressing the region’s demand for seamless and accessible financial solutions.

China, where desktop internet adoption was limited, has long been a mobile-driven market. The shutdown of Google Search in 2010 meant that many Chinese users had their first internet experience through smartphones. This made way for seamless mobile ecosystems like WeChat. Today, WeChat remains dominant, with over 1.38 billion MAU as of September 2024. Its deep integration into daily life, from messaging and social networking to payments and e-commerce, makes it indispensable. Meanwhile, Alipay, another leading super-app, has expanded beyond financial services to include travel bookings, medical consultations, and lifestyle services, further cementing the super-app model’s prevalence in China.

India is emerging as another battleground for super-apps. Paytm, once known primarily as a mobile wallet, now provides banking, lending, and e-commerce services. Tata Neu, launched by the Tata Group, integrates retail, travel, groceries, and payments, aiming to consolidate the conglomerate’s vast business empire under one digital umbrella. With India’s rapidly growing internet economy and government-backed initiatives promoting digital payments, the super-app model is poised for significant expansion. Apart from established players such as Paytm and Tata Neu, several emerging players like IndMoney, Navi, and Jupiter are also offering integrated digital-first solutions across banking, lending, and investments.

The success of super-apps in APAC is further amplified by cultural and economic factors. Many Asian markets share common consumer behaviours and preferences, allowing enterprises to scale services regionally with ease. Additionally, China’s transformation into a near-cashless society, where credit card transactions are rare but Alipay and WeChat Pay are ubiquitous, has influenced neighbouring countries, accelerating the adoption of digital payments.

As APAC’s digital environment continues to evolve, super-apps are set to become even more entrenched in daily life. With increasing investment and innovation, the competition among super-apps will only intensify, reshaping the digital economy and consumer behaviour in the years ahead.

✈ AI-Powered and Value-Driven Travel Apps Gain Traction Among APAC Travelers

Another category to watch is Travel as it continues to expand with steady year-over-year growth in downloads. In China alone, downloads reached 500 million in 2024, while India emerged as the world’s largest individual market, accounting for 15% of global travel app downloads from January to September 2024. Southeast Asia contributed another 8%, highlighting the region’s growing reliance on mobile-first travel solutions.

However, while travel app downloads remain strong, the post-pandemic recovery boom has started to slow, with rising travel costs in 2024 tempering overall growth. Despite this, consumer engagement within travel apps is increasing, with more users spending time planning and booking their trips on mobile.

One key trend shaping travel app marketing is the impressive adoption of AI-driven tools for trip planning and bookings; 61% of travelers in the region now use these. This signifies a clear opportunity for travel brands to integrate AI in their marketing strategies, whether through personalized recommendations, dynamic pricing models or advanced ad formats such as hybrid ads, dynamic creative optimization (DCO), interactive ads, and more.

Another defining shift is how travelers in APAC evaluate brands. Rather than seeking the lowest prices, they prioritize value for money and brand trust. According to a Think with Google survey, these two factors rank highest in their decision-making, while pure price competitiveness lags behind. Additionally, travelers in India, China, and Thailand are showing a willingness to splurge on select “affordable luxuries” such as business-class flights or premium hotel stays if they perceive strong value.

Conclusion

Mobile app marketing in APAC is becoming a springboard for future change agents and present-day innovators.

Generative AI’s wild ride is far from over. Mobile gaming is breaking out of its silo, blending seamlessly with PC and console while alternative app stores are opening new avenues for developers in a fragmented yet high-growth market, and super-apps are solidifying their status as the region’s digital backbone.

Clearly, APAC is not a one-size-fits-all market. Yet, common themes are redefining the region’s mobile economy at scale.

As brands and developers look to the future, they will need to harness emerging technologies and navigate the region’s regulatory and monetization landscape with agility. With user behaviour evolving and competition intensifying, innovation will drive the winners, but staying agile and understanding the local nuances will separate the leaders from the laggards in 2025 and beyond.